Occam’s razor, or the principle of parsimony, says that when seeking to solve a puzzle, first try the simplest explanation. So: Perhaps the Biden administration, with its pronoun police and it’s-for-your-own-good-that-we-are-coming-for-your-stoves annoyances, is riddled with Republican moles bent on making progressivism ridiculous.

How else to explain the Federal Trade Commission’s antitrust worrywarts mounting their high horses and galloping off to rescue affluent consumers from the threat to “affordable luxury” or “accessible luxury” in the market for women’s high-end handbags? Those phrases are, however, semi-oxymorons. And what can “monopoly” mean concerning entirely discretionary purchases?

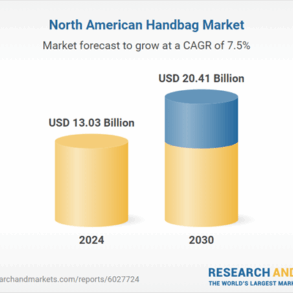

Tapestry, which owns Kate Spade, Stuart Weitzman and Coach, wants to buy, for $8.5 billion, Capri, which owns Versace, Jimmy Choo and Michael Kors. The two firms’ combined 2023 revenue was about $12 billion. This is about $80 billion less than the revenue of the Paris-based luxury giant LVMH, which owns, among many other status conveyors (e.g., Tiffany, Bulgari, Dior, Louis Vuitton), Hermes, which makes Birkins, the ne plus ultra of to-die-for handbags.

The head of the FTC’s Bureau of Competition is spurred to action by a hypothetical: Tapestry, he surmises, wants to become “a serial acquirer,” and merging with Capri would “further entrench its stronghold in the fashion industry.” “Stronghold”? The Tapestry-Capri combination would leave slightly more than 90 percent of the U.S. luxury goods market to competitors. If, however, 10 percent market share triggers FTC antitrust nightmares, the commission’s trust busters will never want for work, which might be the point of its foray into high fashion.

The FTC, which has brooded about the Tapestry-Capri menace for months, thinks the merger might raise prices in the fashion accessories sector. The FTC fretting about the prices paid by the quite affluent who are eager to emulate the seriously wealthy misses this point: Among luxury goods, high prices can be selling points.

In 1976, British economist Fred Hirsch distinguished between the “material economy” and the “positional economy.” The latter concerns things — e.g., luxury handbags — that are inherently enjoyments for the few. When affluence satisfies basic material needs (food, housing, transportation) and yesterday’s luxuries become necessities (e.g., cars, air conditioning) positional goods — e.g., a “choice” suburb, an “exclusive” vacation spot, an “elite” education, beachfront property — gain importance. They are delightful because they cannot become majority enjoyments.

(Paintings are durable positional goods: They are not making any more Monets. Positional goods can, however, be perishable. Is a Columbia University degree still one?)

Thorstein Veblen (1857-1929) understood this in 1899. He was an economist whose mordant prose expressed his unenthralled assessment of the world and everything in it. (He considered a walking stick “an advertisement that the bearer’s hands are employed otherwise than in useful effort.”) He saw everywhere what a Veblen scholar called “the virus of competitive emulation.”

Hence the concept of a “Veblen good”: something for which, in defiance of basic economic reasoning, demand increases as its price does. Inflated prices inflate the buyer’s self-esteem and the envy of the many who are excluded from a small community of positional consumption. Virtue-signaling is an ostentation for the many, available to anyone with strong opinions and moral vanity. Wealth-signaling is for the fortunate few.

The current FTC, which thinks it has a roving commission to prevent all imperfections, actual or anticipated, in the U.S. economy, also opposes the Tapestry-Capri merger because the firms’ hourly wage workers might suffer from diminished competition for such labor. Making a mountain from this hypothetical molehill will strain even the FTC’s imagination: The two companies combined have only 33,000 employees globally, fewer than Walmart has just in Wisconsin.

The FTC might feel less anxiety about the potential exploitation of “conspicuous consumption” customers if it remembers what psychologists call “the hedonic treadmill”: Human beings experience spikes of happiness from many causes — marriage, children, handbags — but soon revert to a stable level of contentment. At least until a new handbag or other luxury good triggers an urge for emulation.

Then the wheels of high-end commerce whir. And purveyors of luxury, while wary of the FTC’s scolds, must calibrate how “affordable” or “accessible” they can make luxury without spoiling the fun of tormenting the excluded.

Today’s FTC is becoming the Cleveland Spiders of federal agencies. The 1899 Spiders lost 40 of their last 41 games en route to a 20-134 record, baseball futility never subsequently matched. The FTC, having lost big cases against Meta and Microsoft, might think it has found in handbags a crisis commensurate with its capacities.

This post was originally published on this site be sure to check out more of their content.