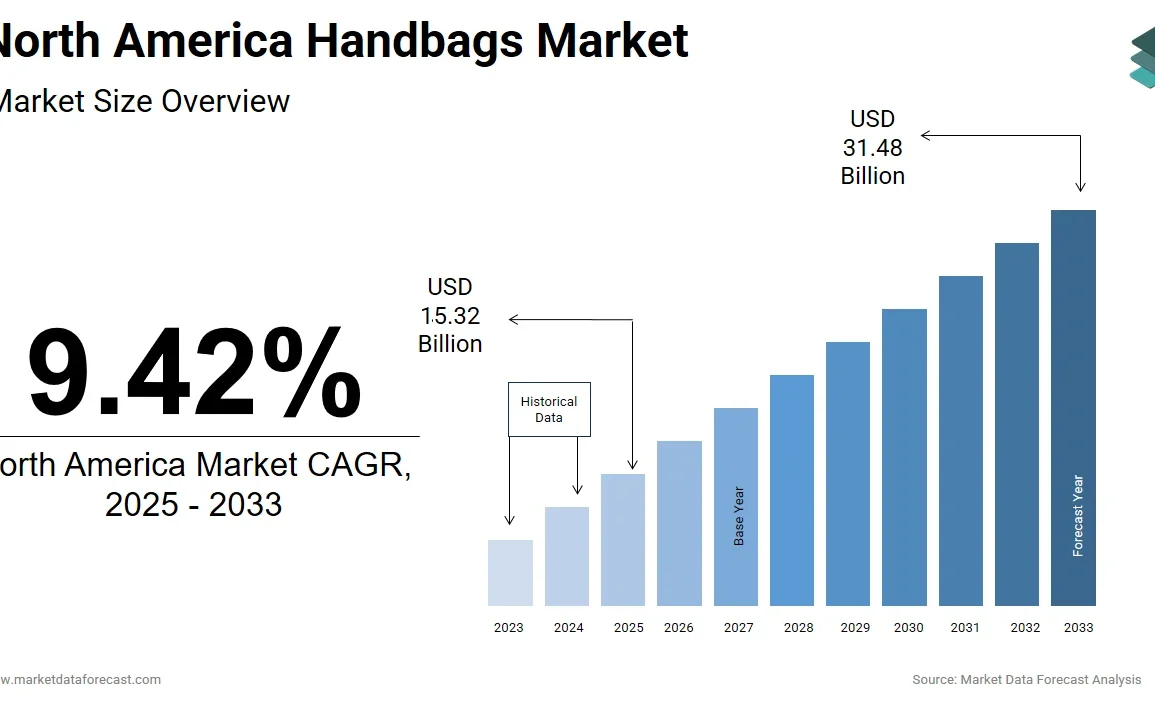

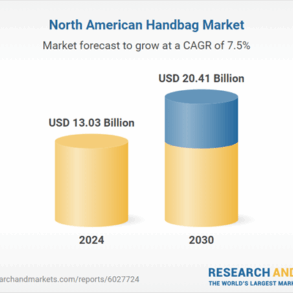

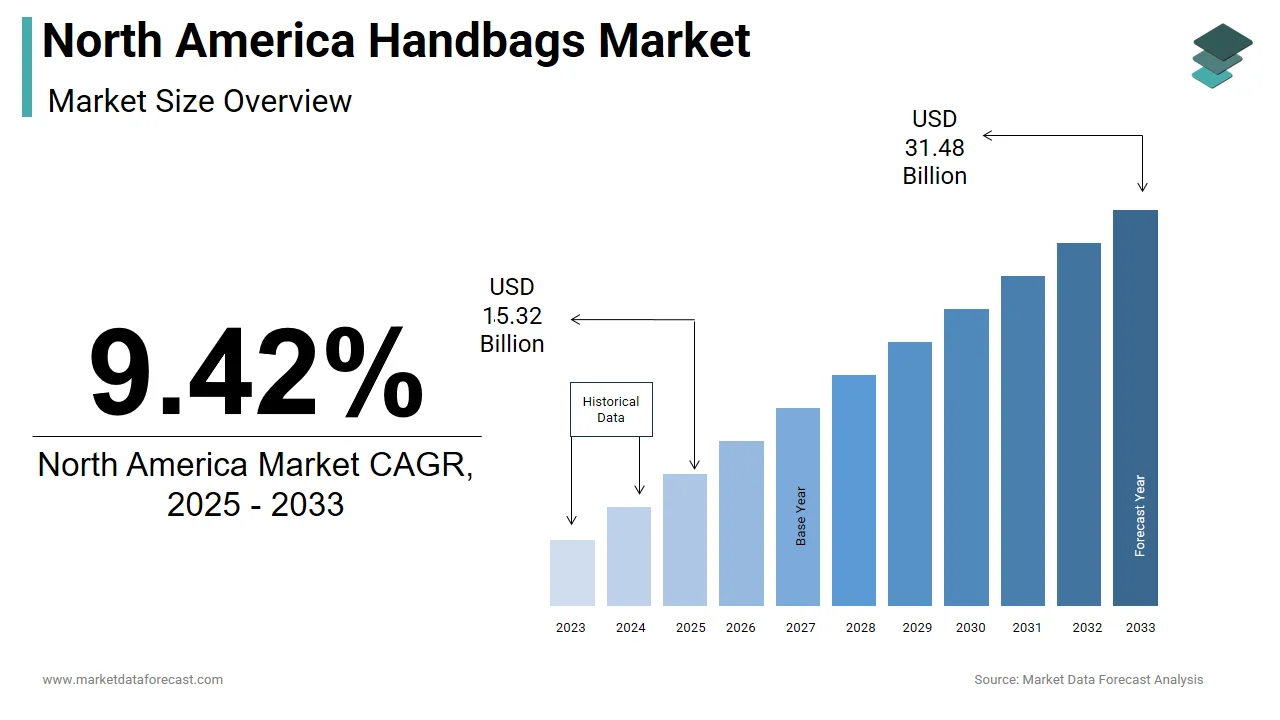

North America Handbags Market Size

The size of the North America handbags market was worth USD 14 billion in 2024. The North America market is anticipated to grow at a CAGR of 9.42% from 2025 to 2033 and be worth USD 31.48 billion by 2033 from USD 15.32 billion in 2025.

The North America handbags market incorporates tote bags, crossbody bags, clutches, backpacks, and luxury designer handbags, catering to diverse consumer preferences across the United States and Canada.

The market is shaped by a mix of global luxury brands, mid-tier designers, and fast-fashion retailers, all competing for consumer attention through innovation, branding, and digital engagement strategies. Moreover, the rise of influencer marketing on platforms like Instagram and TikTok has significantly influenced purchasing decisions, particularly among younger demographics.

Besides, sustainability is gaining traction, with consumers increasingly seeking ethically produced and eco-friendly handbag options. Retailers such as Nordstrom, Saks Fifth Avenue, and Amazon have adapted their inventory and marketing strategies accordingly.

MARKET DRIVERS

Growing Influence of Social Media and Influencer Culture

A key driver of the North America handbags market is the expanding influence of social media and digital influencers who shape fashion trends and consumer purchasing behaviors. Platforms such as Instagram, Pinterest, and TikTok serve as powerful tools for brand exposure, with influencers regularly showcasing new collections, styling tips, and unboxing experiences that drive demand. According to a 2024 survey by Morning Consult, nearly 40% of Gen Z and millennial shoppers admitted to buying a handbag after seeing it featured by an influencer or celebrity. This trend has prompted major brands like Michael Kors, Coach, and Kate Spade to invest heavily in influencer partnerships and user-generated content campaigns. Luxury fashion houses, including Gucci and Louis Vuitto,n have also leveraged micro-influencers and virtual try-on features to engage younger audiences. As reported by Business of Fashion, over 70% of fashion-related social media posts in 2023 included handbags, reinforcing their status as both functional and aspirational items. The viral nature of these trends often leads to limited-edition sellouts and increased brand loyalty.

Rising Disposable Incomes and Urbanization Boosting Luxury Consumption

Another critical factor fueling the North America handbags market is the steady increase in urbanization rates and disposable incomes, particularly in metropolitan areas where premium retail thrives. According to the U.S. Bureau of Economic Analysis, personal disposable income in the United States rose in 2023, contributing to greater discretionary spending on lifestyle and fashion goods. Similarly, Statistics Canada reported a rise in household expenditures on apparel and accessories, especially among high-income earners in cities like Toronto and Vancouver. This economic shift has led to stronger demand for luxury and premium handbags from brands such as Hermès, Prada, and Tory Burch, which are often viewed as symbols of success and exclusivity. High-net-worth individuals and professionals in urban centers continue to drive the secondary market for pre-owned designer bags, further expanding accessibility beyond traditional luxury consumers. As per a 2024 report by Bain & Company, the North American luxury market accounted for nearly 25% of global sales, with handbags representing one of the fastest-growing categories.

MARKET RESTRAINTS

Proliferation of Counterfeit Products Affecting Brand Loyalty

One of the primary constraints affecting the North America handbags market is the widespread availability of counterfeit products, which undermines consumer trust and dilutes brand equity. According to a 2024 report by the Organisation for Economic Co-operation and Development (OECD), counterfeit fashion goods—including imitation handbags—accounted for nearly 3% of global trade, with North America serving as a key destination due to its high purchasing power and e-commerce activity. These fake products, often sold through unauthorized online marketplaces and social media platforms, mimic the design and branding of premium labels, deceiving buyers and damaging legitimate sales. Brands such as Gucci, Louis Vuitton, and Coach have invested heavily in anti-counterfeiting technologies, legal actions, and consumer education initiatives; however, enforcement remains challenging, particularly on third-party platforms. As per the International Trademark Association, a significant percentage of consumers surveyed in North America admitted to unknowingly purchasing counterfeit fashion items, leading to dissatisfaction and reduced repeat purchases. This issue not only affects revenue but also tarnishes brand image, especially when substandard materials and poor craftsmanship lead to negative customer experiences.

Economic Volatility and Inflationary Pressures Reducing Discretionary Spending

Economic instability and inflationary pressures present a notable restraint on the North America handbags market, particularly for mid-to-high-end segments that rely on discretionary consumer spending. According to the Federal Reserve Bank of St. Louis, inflation in the U.S. remained above 3% in early 2024, eroding purchasing power and prompting consumers to prioritize essential expenses over luxury goods. Similarly, in Canada, rising interest rates and cost-of-living concerns have led to cautious spending habits, as highlighted by a 2024 survey conducted by Deloitte Canada. As a result, many potential buyers are delaying purchases of premium handbags or opting for more affordable alternatives. Department store reports indicate a shift toward entry-level designer pieces and second-hand luxury platforms such as The RealReal and Vestiaire Collective, where consumers seek value without compromising on aesthetics. Mass-market retailers like Zara, H&M, and Steve Madden have capitalized on this trend by offering stylish yet budget-friendly designs that closely mirror high-end styles. This economic sensitivity is particularly evident among younger consumers, who now represent a crucial demographic for handbag brands navigating fluctuating financial conditions.

MARKET OPPORTUNITIES

Expansion of Sustainable and Ethical Handbag Brands Gaining Consumer Trust

A significant opportunity emerging in the North America handbags market is the growing demand for sustainable and ethically produced accessories, driven by heightened environmental awareness and shifting consumer values. This shift has encouraged both established and emerging handbag manufacturers to adopt eco-friendly materials such as vegan leather, recycled fabrics, and biodegradable components. Companies like Matt & Nat, Stella McCartney, and Reformation have successfully positioned themselves as pioneers in the sustainable luxury space, attracting environmentally conscious consumers willing to pay a premium for responsible production practices. Major retailers including Nordstrom and Hudson’s Bay, have introduced curated sections dedicated to green fashion, enhancing visibility and accessibility.

Personalization and Customization Trends Enhancing Consumer Engagement

The increasing demand for personalized and customizable handbags is opening new avenues for growth in the North America market, as consumers seek unique products that reflect individual style and identity. According to a 2024 study by Deloitte, over 60% of Gen Z and millennial shoppers prefer brands that offer customization options, ranging from monogramming and color choices to bespoke designs. This trend aligns with the broader shift toward experiential consumption, where customers value not just the product but also the creative process behind it. Leading brands such as Coach, Kate Spade, and Fossil have launched interactive online configurators that allow customers to tailor bag details, including hardware, stitching, and interior compartments. Independent designers and direct-to-consumer startups are also leveraging digital tools to provide made-to-order services, reducing waste and enhancing customer satisfaction. As reported by Shopify, businesses incorporating customization saw a higher conversion rate compared to standard product offerings. Additionally, social media-driven personalization, such as hashtag-based designs and influencer collaborations, is further amplifying engagement.

MARKET CHALLENGES

Rapidly Changing Fashion Cycles Leading to Inventory Overhang and Discounting

A major challenge confronting the North America handbags market is the accelerating pace of fashion cycles, which makes it difficult for brands to maintain consistent product relevance and manage inventory efficiently. Fast-fashion retailers and social media trends have shortened product lifecycles, pressuring companies to continuously introduce new designs to stay competitive. According to a 2024 report by McKinsey & Company, over 40% of fashion retailers in North America faced excess inventory issues due to mismatched supply chain planning and rapidly shifting consumer preferences. This phenomenon has led to aggressive discounting strategies, particularly during seasonal clearance periods, which can erode profit margins and devalue brand positioning. Mid-tier and premium brands such as Michael Kors and Sam Edelman have experienced declining average selling prices as they attempt to clear outdated stock while introducing new collections. Additionally, resale platforms like eBay and Poshmark further complicate pricing dynamics by offering last season’s styles at lower price points. For luxury players, maintaining exclusivity becomes increasingly challenging in an environment where trends emerge and fade within weeks.

Supply Chain Disruptions Impacting Production and Delivery Timelines

Ongoing supply chain disruptions pose a significant challenge to the North America handbags market, affecting raw material sourcing, manufacturing timelines, and final product delivery. Many handbag manufacturers rely on imported materials such as leather, zippers, and hardware from Europe and Asia, making them vulnerable to transportation bottlenecks. These logistical hurdles have led to increased costs and longer lead times, forcing some brands to raise prices or delay product launches. As reported by WWD, several mid-sized handbag producers had to scale back their seasonal collections due to uncertainty in material availability. E-commerce retailers, which depend heavily on timely deliveries to meet consumer expectations, have been particularly affected. While some companies are reshoring production or diversifying supplier networks, these adjustments take time and require significant investment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Tapestry Inc., Fossil Group, Inc., LVMH Moët Hennessy Louis Vuitton, Kering SA, Burberry Group Plc, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The tote bag segment dominates the North America handbags market by accounting for 31% of total market revenue in 2024. This control is basically attributed to the versatile and functional design of tote bags, which appeal to a broad consumer base ranging from students and professionals to fashion-conscious shoppers. Tote bags have also gained popularity among eco-conscious consumers seeking sustainable alternatives to plastic shopping bags. Retailers such as Nordstrom, Coach, and Madewell have capitalized on this trend by introducing reusable, stylish tote designs made from organic cotton, recycled materials, and vegan leather. Additionally, luxury brands like Louis Vuitton and Michael Kors have incorporated premium tote collections into their seasonal lineups, further reinforcing the segment’s dominance.

The sling bag segment is emerging as the fastest-growing category in the North America handbags market, projected to expand at a CAGR of 9.7%. This rapid growth is driven by shifting consumer preferences toward compact, lightweight, and crossbody-style bags that offer both convenience and style. Fashion retailers, including Zara, H&M, and Kate Spade, have introduced diverse sling bag collections tailored to casual, athletic, and luxury markets. The segment has particularly benefited from the rise of athleisure and urban fashion, where functionality meets modern aesthetics. Additionally, travel and outdoor-focused brands like Herschel and Patagonia have expanded their sling bag offerings to cater to adventure enthusiasts and commuters.

By Distribution Channel Insights

Offline retail stores continued to hold the maximum share of the North America handbags market by capturing 58.8% of the total market value in 2024. This command is mainly driven by the enduring importance of in-store experiences, especially for high-end and luxury handbag purchases, where customers prefer tactile engagement before making expensive buying decisions. According to the National Retail Federation (NRF), over 70% of consumers in the U.S. still prefer visiting physical stores when purchasing premium fashion accessories, citing factors such as immediate availability, personalized service, and brand ambiance. Major department stores such as Macy’s, Nordstrom, and Saks Fifth Avenue have maintained robust foot traffic by curating exclusive collections, hosting trunk shows, and offering concierge services for luxury shoppers. In Canada, Hudson’s Bay and Holt Renfrew have similarly reinforced the relevance of brick-and-mortar retail through immersive shopping environments. Apart from these, pop-up shops and brand boutiques—especially in major metropolitan areas like New York, Los Angeles, and Toronto—continue to serve as key touchpoints for customer acquisition and brand loyalty.

Online retail stores represent the fastest-growing distribution channel in the North America handbags market, anticipated to grow at a CAGR of 11.3%. This rapid expansion is fueled by advancements in e-commerce technology, increased mobile shopping penetration, and the growing influence of digital marketing on purchasing behavior. E-commerce giants like Amazon, Farfetch, and Shopbop have played a crucial role in expanding access to both international and domestic brands, allowing consumers to explore a vast array of options beyond what is available locally. Social commerce is also contributing significantly, with platforms like Instagram and Pinterest integrating direct shopping features that enable users to purchase handbags seamlessly while browsing content.

COUNTRY-WISE ANALYSIS

The United States had the dominant position in the North America handbags market by capturing an estimated 86.6% of regional market value in 2024. This control is supported by a combination of high disposable incomes, a well-established retail infrastructure, and a strong presence of both global luxury brands and fast-fashion retailers. Major metropolitan centers such as New York, Los Angeles, and Chicago serve as fashion hubs where new trends emerge and are rapidly adopted nationwide. Department stores, luxury boutiques, and online marketplaces coexist to provide consumers with diverse purchasing options. Additionally, the resale and second-hand luxury market, led by platforms like The RealReal and Vestiaire Collective, continues to expand, providing accessible entry points for aspirational buyers.

Canada is positioning itself as a key largest player in the region. The country’s market growth is driven by rising urbanization, increasing fashion consciousness among younger demographics, and a growing preference for premium and sustainable accessories. Major cities like Toronto, Vancouver, and Montreal serve as key retail centers where global brands such as Coach, Michael Kors, and Kate Spade maintain a strong presence. Canadian consumers exhibit a strong inclination toward mid-range designer products, often opting for items that balance affordability with aesthetic appeal. E-commerce is also gaining traction, with Shopify-powered retailers and multi-brand online platforms facilitating wider product reach.

The remaining North American countries, including Mexico and select Caribbean territories, contributed decent share to the regional handbags market in 2024. While still in the early stages of development, these markets present untapped opportunities due to rising disposable incomes, increasing exposure to global fashion trends, and expanding retail infrastructure. Major Mexican cities like Mexico City, Monterrey, and Guadalajara have seen an influx of international fashion retailers such as Zara, Bershka, and Michael Kors, enhancing brand visibility and accessibility. Domestic players are also stepping up by launching contemporary handbag lines tailored to local tastes. Meanwhile, in the Caribbean, tourism-driven economies like the Bahamas and Puerto Rico are witnessing rising demand for imported and luxury handbags among affluent visitors and expatriates

MARKET KEY PLAYERS

Companies playing a dominant role in the North America handbags market profiled in this report are Tapestry Inc., Fossil Group, Inc., LVMH Moët Hennessy Louis Vuitton, Kering SA, Burberry Group Plc, and others.

TOP LEADING PLAYERS IN THE MARKET

One of the leading players in the North America handbags market is Coach (a division of Tapestry, Inc.), known for its premium leather goods and accessible luxury positioning. Coach has maintained a strong presence through its iconic designs, heritage appeal, and strategic collaborations with contemporary artists and influencers. The brand continues to innovate by blending classic craftsmanship with modern aesthetics, catering to both mature and younger consumers across the U.S. and Canada.

Another key player is Michael Kors (a brand under Capri Holdings Limited), which has become synonymous with aspirational luxury in the handbags category. Michael Kors leverages celebrity endorsements and a global fashion identity to attract a broad consumer base seeking high-fashion appeal at relatively accessible price points. Its collections are widely distributed through department stores, boutiques, and e-commerce platforms, making it a dominant force in North American retail.

Kate Spade New York is another major contributor, recognized for its playful, feminine designs and vibrant color palettes that resonate particularly well with millennial and Gen Z shoppers. The brand, now owned by Tapestry, has successfully expanded beyond handbags into lifestyle accessories while maintaining its core identity. Kate Spade’s emphasis on storytelling and emotional branding has helped it carve out a distinctive niche in the competitive North American market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

A primary strategy employed by key players in the North America handbags market is investing heavily in digital marketing and influencer partnerships. Brands collaborate with fashion influencers, celebrities, and content creators to generate buzz around new collections and maintain relevance in fast-moving fashion cycles. These partnerships help drive engagement on social media and influence purchasing decisions among younger demographics.

Another critical approach is expanding product personalization and customization options. Leading companies are offering monogramming, bespoke color choices, and limited-edition collaborations to cater to consumers seeking unique and individualized products. This not only enhances customer satisfaction but also increases perceived value and brand loyalty.

Lastly, integrating sustainability into product design and supply chain practices is becoming a central strategy. Major brands are introducing eco-friendly materials, ethical sourcing, and transparent production processes to align with growing consumer demand for responsible fashion. By embedding sustainability into their brand narratives, companies are reinforcing long-term competitiveness in a values-driven market.

COMPETITION OVERVIEW

The competition in the North America handbags market is highly dynamic, characterized by a mix of established luxury houses, mid-tier designer labels, and fast-fashion retailers vying for consumer attention across multiple channels. The market is driven by shifting fashion trends, brand perception, pricing strategies, and evolving consumer preferences, especially among younger, digitally native shoppers. Established players leverage heritage, craftsmanship, and exclusivity to maintain their premium positioning, while emerging brands and direct-to-consumer startups focus on affordability, speed to market, and digital-first engagement.

Retailers are increasingly investing in omnichannel strategies to provide seamless shopping experiences, combining physical stores with immersive online platforms. At the same time, the rise of resale and second-hand luxury marketplaces is altering traditional sales dynamics, allowing consumers to access premium products at lower price points. Sustainability and ethical production have also become differentiating factors, influencing purchasing behavior and brand loyalty. With constant innovation, aggressive marketing, and strategic collaborations shaping the landscape, the North America handbags market remains fiercely competitive and continuously evolving.

RECENT MARKET DEVELOPMENTS

- In January 2024, Coach launched a new sustainability-focused capsule collection made from recycled materials, aiming to align with consumer demand for environmentally conscious luxury fashion while reinforcing its brand image as a forward-thinking label.

- In March 2024, Michael Kors opened a flagship store in Toronto’s Yorkdale Shopping Centre, enhancing its physical retail footprint in Canada and providing an immersive brand experience designed to attract affluent shoppers in one of North America’s key fashion markets.

- In June 2024, Kate Spade introduced a digital customization tool on its official website, enabling customers to personalize handbags with initials, colors, and hardware choices, thereby increasing engagement and conversion rates through tailored offerings.

- In September 2024, Tapestry, Inc. acquired a small independent accessories brand specializing in vegan leather handbags, expanding its portfolio to capture growing interest in sustainable and cruelty-free fashion within the North American market.

- In November 2024, Sam Edelman partnered with a popular TikTok fashion influencer to co-design a limited-edition sling bag line, leveraging social media reach and trend-based marketing to tap into Gen Z’s rising preference for compact, stylish, and affordable handbag styles.

MARKET SEGMENTATION

This research report on the North America handbags market is segmented and sub-segmented into the following categories.

By Type

- Satchel

- Clutch

- Tote Bag

- Sling Bag

- Others

By Distribution Channel

- Online Stores

- Offline Stores

By Country

- United States

- Canada

- Mexico

- Rest of North America

This post was originally published on this site be sure to check out more of their content.