Mulberry has recently rejected a takeover proposal from Mike Ashley’s Frasers Group as too low. It insists that its own fundraising measures will be enough to stabilise the company.

British handbag company Mulberry has recently revealed that it has refused a takeover bid from sportswear giant Frasers Group, claiming that the former’s majority stakeholder, Challice, did not back it. The bid is estimated to be worth around £83m (€99.7m).

Mulberry said in a statement: “The board has been informed that Challice is supportive of the company’s strategy and has no interest in supporting the possible offer.”

Challice owns 56.1% of Mulberry at the moment. Based in Singapore, the company is controlled by Ong Beng Seng, a billionaire hotelier, as well as his wife, Christina Ong.

Frasers Group currently has a 36.8% stake in Mulberry at present, with the takeover bid being for the remaining shares, at £1.30 (€1.56) per share. Frasers, owned by British retail entrepreneur Mike Ashley, also owns other companies such as the House of Fraser department stores, Sports Direct, Jack Wills, Agent Provocateur and more.

Mulberry, which has been making losses for several months, has also shared that this bid did not acknowledge its significant future possible value. Instead, the luxury company highlighted that it was confident that its own planned fundraising measures would be enough to turn its finances around.

One of the main fundraising measures includes a share subscription of 10 million shares by Mulberry’s majority stakeholder, Challice, which will be worth £10 million.

Other strategic moves, such as appointing Andrea Baldo as the new chief executive officer (CEO), are also expected to help the company get back on its feet. Baldo was previously the executive director and CEO of Ganni.

Mulberry hit by global luxury sector slowdown

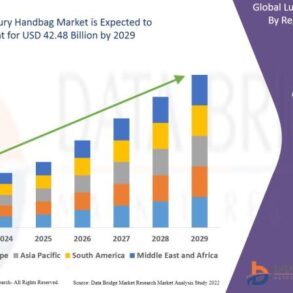

Mulberry, along with other major luxury brands such as Gucci, Burberry and LVMH, has been hit by the worldwide slowdown in the luxury sector with demand especially dampened in key markets like China.

The company recently announced its FY24 results, with group revenues falling some 4% to £152.8m (€183.45m) and an underlying loss before tax of £22.6m (€27.14m).

Christopher Roberts, the chairman of Mulberry, said in the earnings report: “Mulberry continues to be a well-loved British luxury brand, famous for its high-quality craftsmanship and innovative designs.

“However, against rising inflation and macro-economic headwinds, customers became even more selective in their discretionary purchasing and businesses in the luxury space have had to navigate through this.

“This was true for Mulberry, particularly during the second half. Historically, softness in one region would normally be offset by growth in another, however the slowdown during the period has been across all regions and has materially impacted our full year performance.”

Russ Mould, investment director at AJ Bell, said in an email note: “It’s handbags at dawn for Mulberry. Its two major shareholders have different views on who should help the company get back into fashion after a troubled period. Frasers might own 36.8% of the business but that doesn’t mean it holds sway over Mulberry. The target has an even bigger shareholder in 56.1% owner, Challice, and this party doesn’t want to get into bed with Frasers.

“We’re now in a situation whereby Mulberry has rejected a takeover proposal from Frasers but would happily accept its cash as part of a fundraising exercise to strengthen its finances. Challice doesn’t want Frasers to buy the company and believes Mulberry has the strength to dig itself out of a hole.

“It’s a bizarre situation where two parties own 92.9% of a quoted business. One has to question why Mulberry needs to remain on the stock market, given the costs associated with listing versus the relatively small size of the company.

“Challice is a Singapore-based investment vehicle controlled by billionaire Ong Beng Seng who owns luxury retail group Club21. Frasers is a retail conglomerate controlled by billionaire Mike Ashley with a strategy to go more upmarket. Both are logical owners of Mulberry, making this a tricky situation.

“The easy option is for Challice to buy out Frasers at a premium and take Mulberry private, yet Mike Ashley is never one to give things up without a challenge. The fight for Mulberry is as much to do with egos as it is business. Expect more drama to unfold.”

This post was originally published on this site be sure to check out more of their content.