Feb 21, 2025

IndexBox has just published a new report: Middle East – Luggage And Handbags – Market Analysis, Forecast, Size, Trends and Insights.

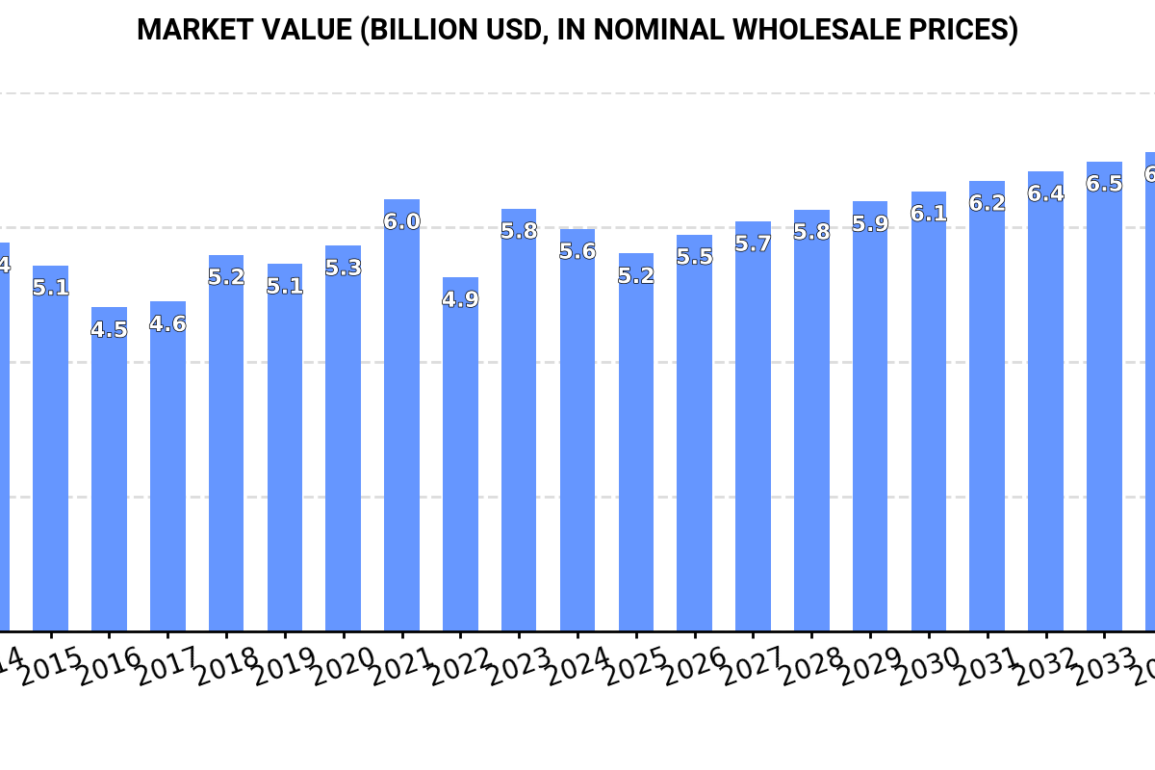

Driven by increasing demand, the luggage and handbag market in the Middle East is forecasted to experience accelerated growth, with a projected CAGR of +1.4% in volume and +1.8% in value from 2024 to 2035. This growth is expected to propel the market to new heights, presenting lucrative prospects for stakeholders in the industry.

Market Forecast

Driven by increasing demand for luggage and handbags in the Middle East, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to accelerate, expanding with an anticipated CAGR of +1.4% for the period from 2024 to 2035, which is projected to bring the market volume to 458M units by the end of 2035.

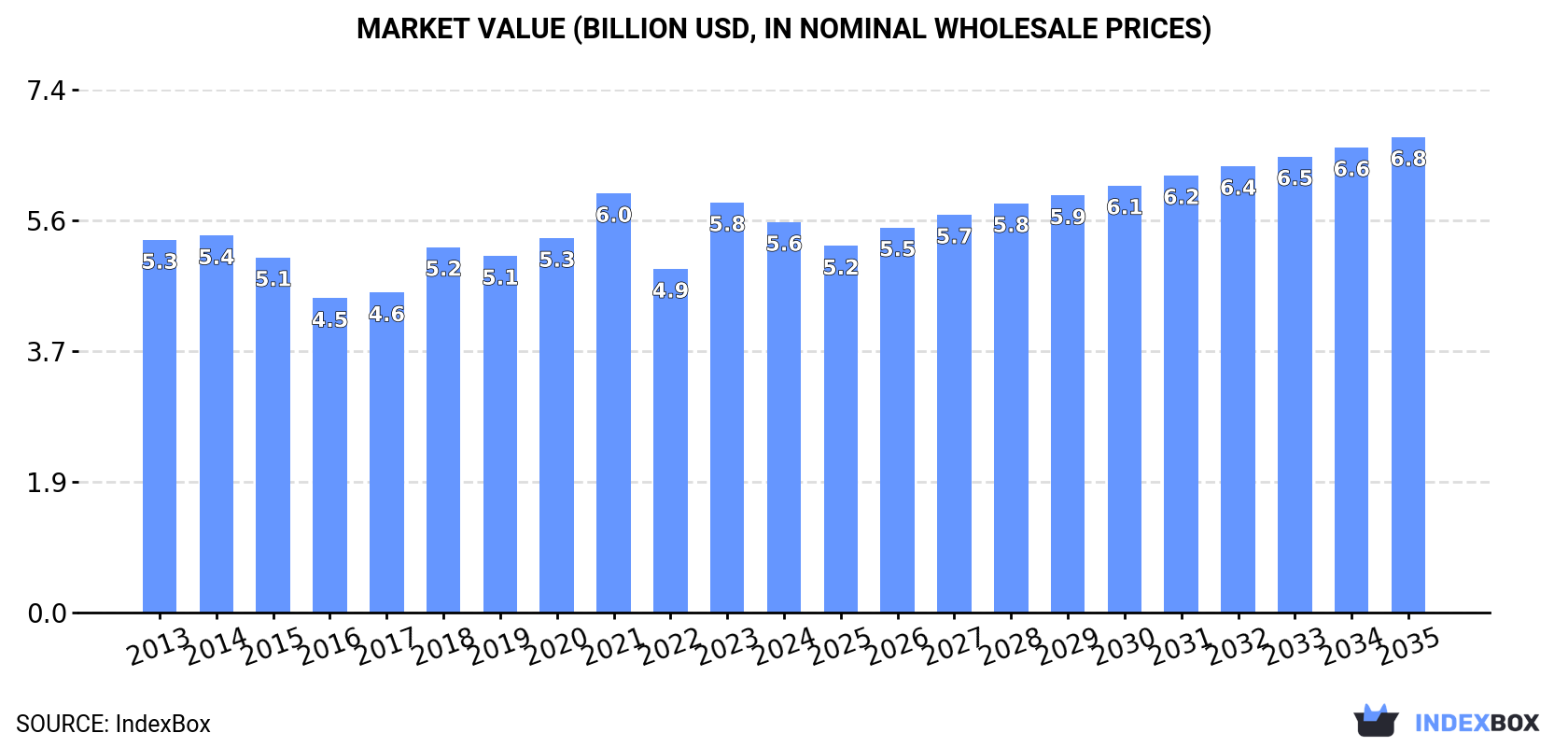

In value terms, the market is forecast to increase with an anticipated CAGR of +1.8% for the period from 2024 to 2035, which is projected to bring the market value to $6.8B (in nominal wholesale prices) by the end of 2035.

Consumption

Middle East’s Consumption of Luggage And Handbags

Luggage consumption was estimated at 392M units in 2024, approximately reflecting 2023 figures. In general, consumption showed a relatively flat trend pattern. As a result, consumption attained the peak volume of 414M units. From 2023 to 2024, the growth of the consumption remained at a somewhat lower figure.

The value of the luggage market in the Middle East reduced to $5.6B in 2024, which is down by -4.8% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). Over the period under review, consumption saw a relatively flat trend pattern. The level of consumption peaked at $6B in 2021; however, from 2022 to 2024, consumption failed to regain momentum.

Consumption By Country

The countries with the highest volumes of consumption in 2024 were Saudi Arabia (115M units), the United Arab Emirates (73M units) and Turkey (68M units), together accounting for 65% of total consumption. Iran, Qatar, Yemen, Syrian Arab Republic, Israel, Jordan and Lebanon lagged somewhat behind, together accounting for a further 29%.

From 2013 to 2024, the biggest increases were recorded for Qatar (with a CAGR of +16.0%), while consumption for the other leaders experienced more modest paces of growth.

In value terms, Turkey ($1.4B), Iran ($1.1B) and Saudi Arabia ($787M) constituted the countries with the highest levels of market value in 2024, together comprising 60% of the total market. The United Arab Emirates, Yemen, Syrian Arab Republic, Lebanon, Qatar, Israel and Jordan lagged somewhat behind, together accounting for a further 35%.

Qatar, with a CAGR of +11.5%, recorded the highest rates of growth with regard to market size among the main consuming countries over the period under review, while market for the other leaders experienced more modest paces of growth.

The countries with the highest levels of luggage per capita consumption in 2024 were the United Arab Emirates (7.1 units per person), Qatar (4.7 units per person) and Saudi Arabia (3.1 units per person).

From 2013 to 2024, the biggest increases were recorded for Qatar (with a CAGR of +13.2%), while consumption for the other leaders experienced more modest paces of growth.

Production

Middle East’s Production of Luggage And Handbags

In 2024, luggage production in the Middle East contracted slightly to 191M units, flattening at the year before. The total output volume increased at an average annual rate of +2.1% over the period from 2013 to 2024; however, the trend pattern indicated some noticeable fluctuations being recorded in certain years. The most prominent rate of growth was recorded in 2018 when the production volume increased by 38% against the previous year. Over the period under review, production hit record highs at 198M units in 2021; however, from 2022 to 2024, production stood at a somewhat lower figure.

In value terms, luggage production declined notably to $3B in 2024 estimated in export price. Over the period under review, production continues to indicate a mild downturn. The most prominent rate of growth was recorded in 2023 with an increase of 47% against the previous year. The level of production peaked at $4.6B in 2021; however, from 2022 to 2024, production failed to regain momentum.

Production By Country

Turkey (101M units) constituted the country with the largest volume of luggage production, accounting for 53% of total volume. Moreover, luggage production in Turkey exceeded the figures recorded by the second-largest producer, Iran (46M units), twofold. Syrian Arab Republic (13M units) ranked third in terms of total production with a 6.8% share.

In Turkey, luggage production increased at an average annual rate of +8.0% over the period from 2013-2024. In the other countries, the average annual rates were as follows: Iran (-3.0% per year) and Syrian Arab Republic (-4.7% per year).

Imports

Middle East’s Imports of Luggage And Handbags

In 2024, imports of luggage and handbags in the Middle East stood at 297M units, rising by 3.6% on the previous year. The total import volume increased at an average annual rate of +1.8% from 2013 to 2024; however, the trend pattern indicated some noticeable fluctuations being recorded throughout the analyzed period. The pace of growth was the most pronounced in 2022 with an increase of 50%. As a result, imports reached the peak of 321M units. From 2023 to 2024, the growth of imports failed to regain momentum.

In value terms, luggage imports amounted to $3.2B in 2024. Total imports indicated a buoyant increase from 2013 to 2024: its value increased at an average annual rate of +5.0% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, imports increased by +129.5% against 2020 indices. The growth pace was the most rapid in 2022 with an increase of 48%. The level of import peaked in 2024 and is likely to continue growth in the near future.

Imports By Country

Saudi Arabia represented the key importer of luggage and handbags in the Middle East, with the volume of imports resulting at 124M units, which was approx. 42% of total imports in 2024. It was distantly followed by the United Arab Emirates (74M units), Turkey (40M units), Qatar (15M units) and Israel (13M units), together achieving a 48% share of total imports. The following importers – Oman (7.1M units) and Iraq (6.2M units) – each recorded a 4.5% share of total imports.

From 2013 to 2024, the biggest increases were recorded for Qatar (with a CAGR of +16.5%), while purchases for the other leaders experienced more modest paces of growth.

In value terms, the United Arab Emirates ($1B), Saudi Arabia ($717M) and Turkey ($709M) were the countries with the highest levels of imports in 2024, with a combined 77% share of total imports.

In terms of the main importing countries, Turkey, with a CAGR of +9.0%, recorded the highest rates of growth with regard to the value of imports, over the period under review, while purchases for the other leaders experienced more modest paces of growth.

Imports By Type

Travel sets; for personal toilet, sewing, shoe or clothes cleaning represented the key type of luggage and handbags in the Middle East, with the volume of imports resulting at 194M units, which was approx. 65% of total imports in 2024. Handbags with outer surface of plastic sheeting or of textile materials (49M units) ranks second in terms of the total imports with a 17% share, followed by cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials (13%). The following types – handbags with outer surface of leather, composition leather, or patent leather (7.3M units) and handbags with outer surface of vulcanised fibre or of paperboard (5.2M units) – each recorded a 4.2% share of total imports.

Travel sets; for personal toilet, sewing, shoe or clothes cleaning was also the fastest-growing in terms of imports, with a CAGR of +15.2% from 2013 to 2024. At the same time, handbags with outer surface of leather, composition leather, or patent leather (+2.7%) displayed positive paces of growth. By contrast, handbags with outer surface of vulcanised fibre or of paperboard (-5.0%), handbags with outer surface of plastic sheeting or of textile materials (-5.3%) and cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials (-7.5%) illustrated a downward trend over the same period. While the share of travel sets; for personal toilet, sewing, shoe or clothes cleaning (+49 p.p.) increased significantly in terms of the total imports from 2013-2024, the share of handbags with outer surface of vulcanised fibre or of paperboard (-2 p.p.), handbags with outer surface of plastic sheeting or of textile materials (-20.5 p.p.) and cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials (-24.8 p.p.) displayed negative dynamics. The shares of the other products remained relatively stable throughout the analyzed period.

In value terms, the largest types of imported luggage and handbags were cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials ($1.1B), handbags with outer surface of plastic sheeting or of textile materials ($898M) and handbags with outer surface of leather, composition leather, or patent leather ($822M), with a combined 90% share of total imports. Travel sets; for personal toilet, sewing, shoe or clothes cleaning, handbags with outer surface of vulcanised fibre or of paperboard, cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of leather, of composition leather or of patent leather and cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of vulcanised fibre or of paperboard lagged somewhat behind, together comprising a further 9.8%.

Travel sets; for personal toilet, sewing, shoe or clothes cleaning, with a CAGR of +7.7%, saw the highest growth rate of the value of imports, among the main imported products over the period under review, while purchases for the other products experienced more modest paces of growth.

Import Prices By Type

In 2024, the import price in the Middle East amounted to $11 per unit, rising by 4% against the previous year. Over the period from 2013 to 2024, it increased at an average annual rate of +3.1%. The most prominent rate of growth was recorded in 2023 an increase of 20%. The level of import peaked in 2024 and is likely to see steady growth in the immediate term.

There were significant differences in the average prices amongst the major imported products. In 2024, the product with the highest price was handbags with outer surface of leather, composition leather, or patent leather ($113 per unit), while the price for travel sets; for personal toilet, sewing, shoe or clothes cleaning ($731 per thousand units) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials (+12.9%), while the other products experienced more modest paces of growth.

Import Prices By Country

The import price in the Middle East stood at $11 per unit in 2024, surging by 4% against the previous year. Over the period from 2013 to 2024, it increased at an average annual rate of +3.1%. The growth pace was the most rapid in 2023 when the import price increased by 20%. Over the period under review, import prices attained the peak figure in 2024 and is likely to continue growth in the near future.

There were significant differences in the average prices amongst the major importing countries. In 2024, amid the top importers, the country with the highest price was Iraq ($18 per unit), while Oman ($4.7 per unit) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Iraq (+17.8%), while the other leaders experienced more modest paces of growth.

Exports

Middle East’s Exports of Luggage And Handbags

In 2024, exports of luggage and handbags in the Middle East rose slightly to 95M units, picking up by 4.3% on 2023. Over the period under review, exports saw a resilient increase. The pace of growth was the most pronounced in 2021 with an increase of 256% against the previous year. Over the period under review, the exports hit record highs at 96M units in 2022; afterwards, it flattened through to 2024.

In value terms, luggage exports dropped modestly to $311M in 2024. Overall, exports posted a perceptible expansion. The growth pace was the most rapid in 2021 with an increase of 35%. Over the period under review, the exports attained the peak figure at $350M in 2022; however, from 2023 to 2024, the exports remained at a lower figure.

Exports By Country

Turkey was the key exporting country with an export of around 73M units, which resulted at 77% of total exports. It was distantly followed by Saudi Arabia (18M units), committing a 19% share of total exports.

From 2013 to 2024, average annual rates of growth with regard to luggage exports from Turkey stood at +16.4%. At the same time, Saudi Arabia (+47.1%) displayed positive paces of growth. Moreover, Saudi Arabia emerged as the fastest-growing exporter exported in the Middle East, with a CAGR of +47.1% from 2013-2024. While the share of Saudi Arabia (+17 p.p.) increased significantly, the shares of the other countries remained relatively stable throughout the analyzed period.

In value terms, Turkey ($196M) remains the largest luggage supplier in the Middle East, comprising 63% of total exports. The second position in the ranking was held by Saudi Arabia ($20M), with a 6.5% share of total exports.

From 2013 to 2024, the average annual growth rate of value in Turkey amounted to +3.2%.

Exports By Type

In 2024, travel sets; for personal toilet, sewing, shoe or clothes cleaning (57M units) represented the major type of luggage and handbags, making up 60% of total exports. Handbags with outer surface of plastic sheeting or of textile materials (20M units) took a 20% share (based on physical terms) of total exports, which put it in second place, followed by handbags with outer surface of vulcanised fibre or of paperboard (15%). The following types – cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials (1.7M units) and handbags with outer surface of leather, composition leather, or patent leather (1.6M units) – each finished at a 3.5% share of total exports.

Travel sets; for personal toilet, sewing, shoe or clothes cleaning was also the fastest-growing in terms of exports, with a CAGR of +25.1% from 2013 to 2024. At the same time, handbags with outer surface of vulcanised fibre or of paperboard (+19.0%) and handbags with outer surface of plastic sheeting or of textile materials (+11.5%) displayed positive paces of growth. By contrast, handbags with outer surface of leather, composition leather, or patent leather (-2.2%) and cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials (-2.4%) illustrated a downward trend over the same period. From 2013 to 2024, the share of travel sets; for personal toilet, sewing, shoe or clothes cleaning and handbags with outer surface of vulcanised fibre or of paperboard increased by +33 and +3.3 percentage points, respectively.

In value terms, handbags with outer surface of leather, composition leather, or patent leather ($98M), handbags with outer surface of plastic sheeting or of textile materials ($78M) and cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials ($50M) constituted the products with the highest levels of exports in 2024, together accounting for 73% of total exports. Handbags with outer surface of vulcanised fibre or of paperboard, travel sets; for personal toilet, sewing, shoe or clothes cleaning, cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of leather, of composition leather or of patent leather and cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of vulcanised fibre or of paperboard lagged somewhat behind, together comprising a further 27%.

Travel sets; for personal toilet, sewing, shoe or clothes cleaning, with a CAGR of +16.3%, recorded the highest growth rate of the value of exports, in terms of the main exported products over the period under review, while shipments for the other products experienced more modest paces of growth.

Export Prices By Type

The export price in the Middle East stood at $3.3 per unit in 2024, shrinking by -8.3% against the previous year. In general, the export price showed a abrupt shrinkage. The most prominent rate of growth was recorded in 2020 when the export price increased by 23% against the previous year. Over the period under review, the export prices attained the maximum at $11 per unit in 2013; however, from 2014 to 2024, the export prices remained at a lower figure.

Prices varied noticeably by the product type; the product with the highest price was handbags with outer surface of leather, composition leather, or patent leather ($61 per unit), while the average price for exports of travel sets; for personal toilet, sewing, shoe or clothes cleaning ($509 per thousand units) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by cases and containers; trunks, suit-cases, vanity-cases, executive-cases, brief-cases, school satchels and similar containers, with outer surface of plastics or of textile materials (+10.9%), while the other products experienced more modest paces of growth.

Export Prices By Country

In 2024, the export price in the Middle East amounted to $3.3 per unit, falling by -8.3% against the previous year. Overall, the export price saw a abrupt curtailment. The most prominent rate of growth was recorded in 2020 when the export price increased by 23% against the previous year. The level of export peaked at $11 per unit in 2013; however, from 2014 to 2024, the export prices stood at a somewhat lower figure.

There were significant differences in the average prices amongst the major exporting countries. In 2024, amid the top suppliers, the country with the highest price was Turkey ($2.7 per unit), while Saudi Arabia stood at $1.1 per unit.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Turkey (-11.3%).

Source: IndexBox Market Intelligence Platform

This post was originally published on this site be sure to check out more of their content.