British luxury brand Mulberry rejected retailer Frasers‘ 83-million-pound ($111 million) takeover proposal on Tuesday, saying its majority shareholder did not support the bid and that it undervalued the company.

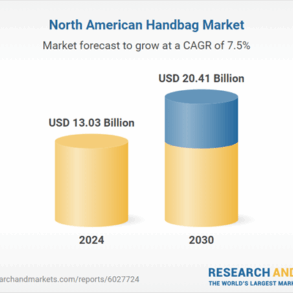

Loss-making Mulberry, known for its luxury handbags and belts, on Friday made public plans to raise capital from shareholders.

That includes a 10-million-pound proposed subscription from Challice, its 56% Singaporean backer owned by billionaires Christina Ong and Ong Beng Seng.

“The board has been informed that Challice is supportive of the company’s strategy and has no interest in supporting the possible offer,” Mulberry said in a statement.

Shares in Mulberry have plunged by about 95% from their all-time highs in May 2012. They had rallied on Monday on the prospect of a Frasers’ takeover at a proposed 30% premium to the subscription price.

They were down 2.4% at 121 pence in light trading by 0811 GMT.

Frasers has until Oct. 28 to make a formal offer or walk away.

Controlled by Mike Ashley and Mulberry’s second-biggest investor, Frasers said in its proposal it would have been willing to underwrite the subscription in its entirety, potentially on better terms for Mulberry.

The company, whose “elevation strategy” is to take the business more upmarket, has been trying to make inroads into the luxury goods space with its purchase of THG’s portfolio of luxury goods websites in June and online player MATCHES last year.

MATCHES collapsed into administration in March and Frasers bought its intellectual property assets the following month.

It said on Monday it wanted to avoid another Debenhams situation. Debenhams, a department store in which Frasers invested 150 million pounds, went out of business in 2021.

Mulberry said the appointment of CEO Andrea Baldo and its capital raising plans should help it to turn around its business.

It had no plans to withdraw or terminate the subscription or retail offer, but would engage with Frasers regarding a pro rata participation in the subscription, Mulberry said.

Mulberry said Frasers’ proposal did not recognise the company’s “substantial future potential value”.

This post was originally published on this site be sure to check out more of their content.