MILAN — Ferragamo is doubling down on its core leather business.

This was the clear message Ernesto Greco, executive board member, conveyed on Wednesday evening to analysts during a conference call to comment on first-quarter sales, which were down 2.6 percent to 221 million euros compared with 227 million euros in the same period last year. At constant exchange rates, revenues decreased 1 percent. The performance was impacted in particular by the negative consumer environment in Asia-Pacific and the weak performance of the secondary direct-to-consumer channel.

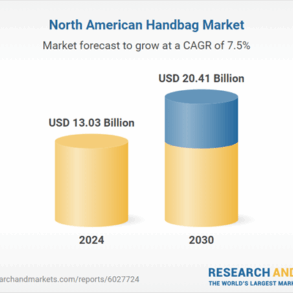

Handbags helped drive the performance in the first quarter and the company is banking on it being the best performing category going forward. There will be “the introduction of some new skus in the men’s and women’s shoes. So we should, especially in the second portion of the year, see some improvement in this category,” said Greco, highlighting the “renovated focus on the accessories and also on the silk items, for two reasons.” Because of a newfound interest in accessories and in silk items, and because “it is easier to make cross-selling with these products.”

You May Also Like

The idea, he continued, is to “reinforce the cross-selling activity,” building on the good signs already seen. “Still, this is only an early stage. We want to reinforce this ability, both introducing new products, but also having a different display in the stores. In other words, we believe that we should dedicate in our stores more space on the shelves to leather products and accessories, and probably to decrease a little bit the space dedicated to [apparel].” The brand is also strengthening the carryovers such as the Hug bag and introducing new bestsellers like the Soft bag.

“Maybe in the past we didn’t put enough attention to some markets,” and Ferragamo is now aiming at “creating a sort of derivative products, for example, the Hug was designed especially for the American and European markets, and we believe that we should apply some fine-tuning in order to have this model also tailor-made for the Chinese and Asian markets, because they require some differentiations. The idea is to act in a sort of local way in the product assortment, much more focused than in the past.”

No questions were asked about the future of creative director Maximilian Davis, as support for the designer was expressed in March by chairman Leonardo Ferragamo, nor about the potential arrival of a new chief executive officer, following the exit of Marco Gobbetti two months ago. Observers believe it is unlikely an appointment will be made before the second half of the year.

To be sure, there were indications that the brand was seeing improvements in leather goods in the first three months of the year, as sales of the category were up 9.6 percent to 96.2 million euros, representing 44.2 percent of the total. On the other hand, footwear revenues fell 9.6 percent to 92.1 million euros, accounting for 42.3 percent of the total and apparel was down 3 percent to 13 million euros. Silk inched down 1.9 percent to 16.2 million euros.

The uncertain global scenario affected the performance of women’s footwear, said Greco, and “that’s why we started at the beginning of February to launch a new program which has a special focus on women’s shoes. We believe that we have lost some ground in this category, and we are ready to present some additional products next month, especially in the pumps and ballerina category.” At the same time, the company will re-emphasize the focus on the high-quality menswear Tramezza shoe. “This is quite important because it is sort of an answer to what we believe is in the market, a sort of polarization, and a special focus should be put on the high-end products.”

Backstage at Ferragamo, spring 2025.

Giovanni Giannoni

While there are new handbag models that are in the high-end price range, Ferragamo is also “working on introducing entry price models, because there are customers who are ready to buy luxury products but are not ready to spend too much,” Greco remarked.

“The difficult macroeconomic environment, weighing on consumers’ confidence, impacted the first quarter’s performance, driving a decrease in traffic, only partly offset by higher conversion rate and increase in the average ticket,” Greco said.

In the three months ended March 31, the direct-to-consumer channel registered positive results in Europe, Japan and Latin America, neutralized by the negative performance in Asia-Pacific, and reported a 3.6 percent decline to 163.7 million euros, accounting for 74.1 percent of the total. Twenty store renovations and 20 closures are planned for the year, said Greco. As of March 31, there were 362 Ferragamo boutiques.

The wholesale channel posted a good performance in all geographies, said Greco, reporting a 7.9 percent increase to to 54 million euros, but he was cautious, saying it “remains sort of volatile,” and adding that “probably the good performance was at least partially related to a certain stock build-up activity.”

Asked about potential price increases, in light of President Trump’s tariffs, Ferragamo in the U.S. is “ready to implement some price increase, let’s say middle single-digit and, of course, probably we will apply also a fine-tuning price increase in all the other markets, in order to balance the pricing gap between different territories.”

By geographies, sales in the Europe, Middle East and Africa region were up 9.1 percent to 54.2 million euros, representing 24.9 percent of the total. The primary DTC continued to overperform the secondary channel, driven by both tourists, in particular by American customers, and local purchases.

North America rose 3.7 percent to 62.2 million euros, representing 28.6 percent of the total and Japan grew 4.1 percent to 20.8 million euros or 9.6 percent of the total mainly driven by tourists’ purchases.

Asia-Pacific fell 13 percent to 63.7 million euros, representing 29.3 percent of the total challenged by the overall weak consumer environment significantly impacting traffic. “I would say that the Chinese market probably already achieved a sort of bottom-line performance, because the decrease in traffic was already material in the first period of the year, and we are having now a sort of stabilization,” said Greco.

Sales in Central and South America edged down 0.8 percent to 16.5 million euros.

Asked about current trading, Greco said that “in the last 10 days of March, we have seen a lot of negative events impacting the luxury business, from the crash of the financial market to the commercial war between the U.S. and China, and the imposition of tariffs. So certainly all these events impacted the consumer attitude in buying and we have seen a decrease in traffic as well as in the level of sales.”

Most impacted were the U.S. and Europe, and in the former, “the problem is related to the local customers. While in Europe, we have seen a certain decrease in the tourism level, especially the Americans. I would say that April was certainly negative, while especially the last week of May is improving, maybe related to some good news coming from the market. Of course, we are not in a position now to say that this is a solid change, we will see. To be honest, I believe that we need a sort of fortune teller in order to understand what is going to happen.”

This post was originally published on this site be sure to check out more of their content.