The British handbag brand was once the ultimate ‘it girl’ accessory, pined after by hordes of Alexa Chung imitators. Now, it’s in need of some serious cash. Here, we go round the Mulberry push to find a buyer.

It’s been a turbulent time for Mulberry after it reported a £34m pre-tax loss in its year-end financial results, with sales down 18%. Its search for a buyer has gone a little awry after a bid from Frasers Group and a new majority stakeholder in legal woes. So, what went wrong for Mulberry and how can its brand be turned around?

The Mike Ashley-owned Frasers Group has been battling it out to takeover Mulberry to join its portfolio of brands, which include Sports Direct, Lonsdale and House of Fraser, but Mulberry rejected the first £83m bid and since rebuffed a second £111m bid. Mulberry’s board said the offer “does not recognize the company’s substantial future potential value,” with founder Roger Saul having hoped French luxury group LVMH would step in and make a bid – an offer that never transpired.

On Thursday (October 7), Mulberry said it had raised £10.4m, split between Frasers Group, which put in £3.96m, and the Singapore family investment firm Challice, which took a majority 56% stake. The drama didn’t end there, however, with Challice owner Ong Beng Seng being charged in Singapore for giving gifts to a former cabinet minister who is serving prison time for accepting said gifts. Only partially topped up by the £10.4m, Mulberry remains in an offer period.

While billionaires might have been tussling for control over Mulberry, the lack of interest from the LVMHs of this world suggests the brand isn’t as desirable as it once was.

Powered by AI

Explore frequently asked questions

So, what went wrong?

Looking at the British brand with a Parisian lens, Deborah Marino, Publicis Luxe’s chief strategy officer, says Mulberry has always had a thing for ‘it girls,’ “…a sixth sense, an intuition about the personalities shaping the zeitgeist.” She says, however, that “it takes more than that to build up an icon and the main risk is to copy the Kelly without the grace.”

The brand had a real hay-day in the mid-00s when Alexa Chung was its biggest ambassador, leading to the creation of its most popular range, which was named after her. But as Chung’s contemporary relevance dipped, so did the brand’s.

Marino advises Mulberry to be less concerned with personalities and instead “choose to reignite the true expression of Mulberry’s British flair: the Bayswater, born in 2003, a ladies’ dream and one of the most satisfactory reasonable luxuries of its generation.” [Bayswater was a famous West London shopping center].

She also asks if the supposedly iconic British brand is British enough. Mulberry was founded in the English county of Somerset in 1970, with its logo and name taken from the tree that founder Saul would pass on his way to school. The products are inspired by rural hobbies such as shooting, fishing and hunting. It is also the largest leather manufacturer in Britan, with half of its stock still being made in Somerset.

This history and heritage are what Marino says Mulberry should be pulling on. “There is a temptation to forget about its roots and get rid of its memories and archives, to become a global, overly expensive and cold brand. Well, that’s a game you can play when you are an ultra-contemporary brand. But with little to no creative signature, your past is your treasure.” The 70s style or the 2000s heyday when women flocked to the brand would be the ideal places to start, she adds.

Brand strategist and ex-House 337 exec Zara Ineson believes Mulberry fell out of touch with how people are engaging with luxury. “We’ve seen a shift in luxury brands expanding their approach to marketing to be social first, with timely talent partnerships that hit the cultural zeitgeist. Think Jacquemus’s viral social stunts or the Jeremy Allen White moment for CK.”

Advertisement

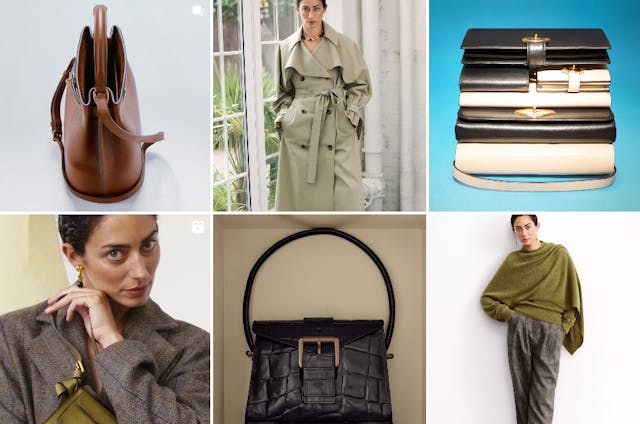

Mulberry’s social pages mostly consist of well-curated images of its products or models styling its bags, as well as the promotion of its B Corp status. On TikTok, there are videos of how to repair its products and some UGC clips such as ‘what’s in my bag’ videos. Ineson says Mulberry has the potential to be the British version of the US handbag brand Coach: “Iconic, accessible luxury design that steps in time with culture.” Unfortunately, though, the Mulberry brand “feels flat,” she says. “It isn’t front of mind because it’s missing that scroll-stopping magnetism that generates talkability and values cultural-first creativity over playing it safe.”

Similar to Ineson, Turhan Osman, a creative director at House 337, thinks Mulberry has “fallen short” of staying culturally relevant. “It’s almost as if Mulberry has been too pure and true to its roots: grown-up, sophisticated and luxury.” It needs to broaden itself to a mainstream audience to thrive in the future, says Osman.

“In tough times, you need an audience pool that is as big as possible. For every middle-aged Chelsea ‘yummy mummy’ who had to rein back on a Mulberry purchase, there isn’t an 18-year-old influencer waiting to splurge her whole paycheck on a bag in their place.”

Advertisement

How should Mulberry get back in vogue?

From a media perspective, Ed Cox, who is managing director and media lead at The Beyond Collective, says Mulberry hasn’t been spending enough compared with its competitors. Since 2020, Nielsen reports £371,000 spend from Mulberry compared with Louis Vuitton’s £4.5m. Admittedly, Louis Vuitton is a global leader but Cox says brands such as Loewe, Coach, Prada, Fendi and Miu Miu are spending over £1m in this period.

“Media for luxury brands is as much – if not more – about signaling as it is about reach and frequency,” says Cox. Spending money on costly ad placements such as double-page spreads in luxury magazines or high-profile out-of-home could seriously help the brand. “It is an important part of implicitly communicating the brand’s image, stature and significance.”

Suggested newsletters for you

Daily Briefing

Daily

Catch up on the most important stories of the day, curated by our editorial team.

Ads of the Week

Wednesday

See the best ads of the last week – all in one place.

The Drum Insider

Once a month

Learn how to pitch to our editors and get published on The Drum.

Publications such as Vogue and Harper’s Bazaar still hold clout with the fashion industry and trendsetters. “And that’s before you consider that there’s also the long-known association between commercial ad spend and editorial coverage in these publications,” says Cox, who adds that it’s “funny how the brands with the biggest media spend always seem to get written about the most.” Cox doesn’t think Mulberry needs to go away and spend millions on paid media straight away but instead advises a few well-chosen placements at key times in the year or around key product launches to boost its image.

On the creative side, Zaid Al-Zaidy, chief executive officer at The Beyond Collective, says that since luxury is an expense that can’t be justified, Mulberry needs a strategy for “irrational” desire. Al-Zaidy, who was head of the agency when it created the Mulberry Softie launch campaign, says this can’t be “artificially” created with a new brand positioning, but it has to come from within.

“What is the big truth about Mulberry that can inspire its entire organization, its designers, partners and collaborators, its entire customer experience and give the brand a legitimate way to create cultural capital, not just desperately hang on to it? The brand needs some good old-fashioned brand archaeology, filtration and commercial storytelling, blending the arts of brand belief and behavior.”

Mulberry needs to get the basics right, Al-Zaidy says, and to commit to a new, consistent strategy.

This post was originally published on this site be sure to check out more of their content.