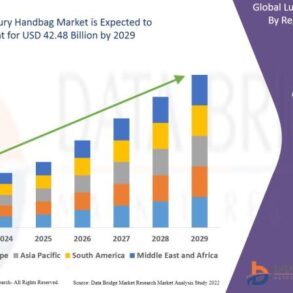

Handbag giants Capri Holdings Ltd. and Tapestry, Inc. should have recognized that their $8.5 billion merger would bust under federal antitrust scrutiny before prompting the former’s largest stock drop, a proposed class action says.

Capri investor David Hurwitz alleges that the luxury handbag market’s biggest competitors misled investors about the reliability of their merger plans, resulting in them paying artificially inflated prices for the company’s shares and suffering losses when they fell, according to his suit filed Dec. 23 in the US District Court for the District of Delaware.

Capri—behind Michael Kors, Jimmy Choo, and Versace—and Tapestry—owner of Coach, Kate …

This post was originally published on this site be sure to check out more of their content.