- With some designer bags costing upwards of $10,000, they can be investments

- Buying specific bags from brands like Chanel can bring potential resale value

- FEMAIL spoke to multiple handbag experts who revealed what purses to buy

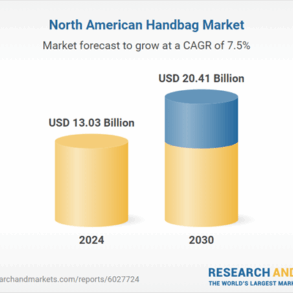

While most people invest their money in bonds, stocks and real estate, there’s a new category of capital that’s drumming up some attention – designer bags.

With some designer handbags from brands like Chanel and Hermès now costing upwards of $10,000, it has opened up a potential for future resale growth.

If the bags are rare or limited-edition, such as the Hermès Birkin Sunset Rainbow 35, their value can go up with time, and you could have a serious opportunity to cash in on a resale site or even an auction house like Sotheby’s.

‘Handbags have now firmly solidified their place as an asset class,’ Judy Taylor, Founder and CEO of luxury resale seller Madison Avenue Couture, told DailyMail.com.

Taylor cited a 2022 report by Credit Suisse, which named handbags as one of the best collectible investments for the 2023 year.

The category came before other divisions like art and jewelry when it came to growing resale value.

‘The Credit Suisse report stated that the average value of designer purses has increased by 92 per cent in the last decade, whereas art increased by 84 per cent and jewelry by 53 per cent,’ Taylor divulged.

‘Ironically, many people acknowledge that art and watches as collectible and asset classes, but have not regarded handbags as such,’ she added.

In the report, Credit Suisse stated that bags from Hermès and Chanel have been the most lucrative when it comes to resale opportunity and value.

Both brands ‘have consistently outperformed broader financial markets over the past two decades,’ Taylor explained to DailyMail.com.

The CEO said that it’s specifically the Hermès Birkin and Kelly handbags and the Chanel Classic Flap handbags that make the best investments.

‘The demand for these bags significantly outweighs the supply,’ she said, noting that she doesn’t think that will change in the near future due to both of the brand’s exclusive sales strategies.

Sherry Farrahi, founder of Los Angeles-based Style Maven, a luxury fashion concierge, often recommends her clients invest in either an Hermès Birkin 25 or a mini Kelly when buying from the luxury brand.

‘Hermès and Chanel are always going to be great choices because you get high quality that holds its value over time and therefore is a very smart investment,’ Farrahi told DailyMail.com.

She said that she often steers her clients towards bag styles that have a ‘classic silhouette’ and ‘high function’ – for example, Chanel’s $4,400 Nano Shopping Bag.

But if you’re not interested in putting your money in Chanel or Hermès, there are other designers that also hold substantial value.

Taylor told FEMAIL that the Goyard St. Louis tote and Louis Vuitton Neverfull are two bags that are both in limited supply and will retain their value.

‘If properly cared for, they can always be resold, typically at more or close to the original purchase price, or passed down to the next generation,’ Taylor shared.

Farrahi suggests anything from Bottega Veneta’s Andiamo collection, particularly the nearly $3,000 clutch, which she called a ‘smart investment’ due to how in-demand it is right now.

Of course, there are always the ‘trendier’ bags that are popular and in high demand for just one season or that come back in to style every now and again, like the original Balenciaga City bag, according to Taylor.

These kinds of bags will often sell for less than their original price, she explained.

Farrahi has noticed that her clients are moving away from purchasing ‘trendy’ bags and are instead going for ‘functional classics,’ like the Birkin.

‘If they like a bag, they will purchase it in multiple colorways and fabrications,’ the stylist noted.

But the style or brand of bag you’re buying may not be the only thing you need to consider when thinking about its future value.

Things like color can play a role in your ability to re-sell it or its potential to grow in price.

While neutrals can often ‘retain the best upside,’ according to Taylor, some shades of pink, like Bubblegum and Rose Sakura, can increase value in an Hermès bag.

‘Colorful bags often increase in value because a particular color is created for a specific season and often not seen again for years if ever,’ Farrahi explained.

‘The more rare the color, the greater the investment value.’

It’s also important to take care of your bag, being careful to keep its shape and avoid staining.

However, despite some of the perks that come with your designer handbag, Taylor stressed that all bags should be bought to be worn and enjoyed – and you should buy what you like.

‘Regardless of the designer, a high-end luxury handbag is a good investment because it will fetch a better return in the resale market than clothing or even shoes,’ Taylor said.

She also noted that investment returns on handbags may not always be better than other asset classes like stocks, bonds and gold.

‘Prices at auction which is how the return was calculated have proven to be volatile,’ Taylor admitted.

Financial expert Vivian Tu, also known as Your Rich BFF, doesn’t necessarily think most handbags, besides classics from Hermès or Chanel, are the best investment – and agrees that other securities may be a better option to invest in overall.

‘It’s totally okay to treat yourself to something nice every so often, but I wouldn’t consider these purchases an investment,’ Tu told DailyMail.com.

‘Instead, when it comes to investing, I recommend people invest in a diversified portfolio of age and risk appropriate ETFs (exchange-traded funds) and mutual funds that will help prepare them for their futures.’

When it comes to re-selling fashion items, Tu recommended putting investments in watches like Rolex, Patek Philippe, and Audemars Piguet.

‘These tend to hold their value the best, if not appreciate over time,’ the former Wall Street trader said.

This post was originally published on this site be sure to check out more of their content.