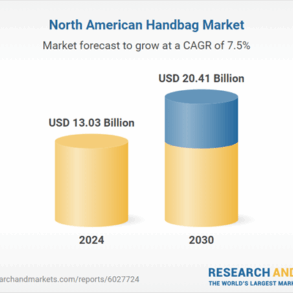

(Reuters) -Tapestry on Thursday raised its 2025 revenue and profit forecasts for a third time this year, taking advantage of its limited exposure to the sweeping U.S. tariffs and higher full-price sale of its popular Coach handbags.

Its shares jumped 8.5% in premarket trading as steady demand for the company’s Tabby, Brooklyn and Empire leather handbags among younger shoppers in North America and China helped it beat third-quarter results expectations.

The company’s sales benefited from product innovations, a sharp marketing strategy and full-price selling and come despite a downturn in the luxury market that has hurt players such as French luxury groups LVMH and Kering.

Tapestry’s price increases boosted margins, which grew 140 basis points in the quarter from last year.

Sales in its biggest North America segment rose 9%, while in Europe it surged 32%. Coach, which makes up roughly 80% of overall sales for Tapestry, saw sales grow 13% from last year.

Coach products are made in Vietnam, Cambodia, the Philippines and India with no vendor providing 10% or more of total inventory purchases, according to Tapestry’s 2024 annual report. It also had limited exposure to China.

The company divested its footwear brand Stuart Weitzman in February to Dr Scholl’s footwear owner Caleres for $105 million.

That was part of its effort to focus on higher-margin Coach and Kate Spade businesses following a failed attempt to merge with Michael Kors-owner Capri last year.

Tapestry expects profit of around $5 per share, compared to a prior forecast of $4.85 to $4.90. Annual revenue is projected to be about $6.95 billion, compared to its earlier expectation of more than $6.85 billion.

Net sales for the quarter ended March 29 came in at $1.58 billion, above estimate of $1.53 billion, according to data compiled by LSEG. It earned $1.03 per share, beating estimates of 88 cents.

(Reporting by Savyata Mishra in Bengaluru; Editing by Arun Koyyur)

This post was originally published on this site be sure to check out more of their content.