LVMH lost its title as Europe’s most valuable luxury company — and Hermès didn’t need a runway to take the lead.

The luxury conglomerate behind Louis Vuitton, Christian Dior and Sephora reported €20.3 billion in revenue for the first quarter of 2025. While that signals solid performance, particularly in Europe, a softer U.S. market, lower sales in Japan and continued tariff uncertainty weighed on the results.

Following the report, LVMH shares dropped 7%, lowering its market capitalization to €246 billion. According to CNN, this allowed rival Hermès to claim the top spot at €247 billion.

While LVMH has a broader portfolio and greater global reach, Hermès’ steady rise signals a shift in consumer and investor sentiment. As high-end shoppers gravitate toward timeless, low-key luxury over label-heavy branding, the market is responding — and so are those betting on the future of fashion as a financial asset.

As the economy continues to fluctuate under the weight of tariffs and recession fears, investors and high-end consumers are shifting their attention to luxury goods that don’t just turn heads — they hold value. Hermès, with its measured growth and fiercely loyal clientele, has emerged as a clear front-runner in the luxury space, ahead of some flashier, trend-driven rivals.

LVMH, for example, reported a 3% drop in first-quarter sales — a miss compared to analysts’ expectations for 2% growth. The decline reflects broader market unease, amplified by President Donald Trump’s recent tariff announcements.

In response, consumers are rethinking what luxury really means. Instead of chasing seasonal drops, they’re investing in pieces with lasting value. Take the Birkin 30 in Togo leather that retails for around $12,500, but can resell for up to $30,000 — a return of about 140%.

“Luxury collectibles have delivered for investors over the long term. If you had invested US$1 million in 2005 and tracked KFLII, your investment would now be worth US$5.4 million,” Liam Bailey, Knight Frank’s global head of research, told Forbes. “The same amount invested in the S&P 500 would have been worth US$5 million by the end of 2024.”

And while not everyone has the funds for a five-figure handbag, Hermès’ wealthier clientele does. That’s part of what makes the brand so resilient, according to Jelena Sokolova, senior equity analyst at Morningstar, who notes that its customers are less affected by economic slowdowns and more focused on timeless value than trend-chasing.

Read more: This hedge fund legend warns US stock market will crash a stunning 80% — claims ‘Armageddon’ is coming. Don’t believe him? He earned 4,144% during COVID. Here’s 3 ways to protect yourself

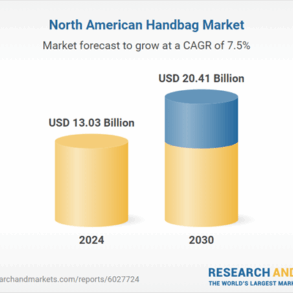

Luxury handbags aren’t just fashion statements — they’re becoming portfolio pieces. But not all Birkins are created equal. Value can hinge on everything from the model and year of production to the leather quality and color.

If you’re thinking of adding a designer bag to your list of alternative assets, you’ll need to do your research just like you would with stocks: study historical resale trends, monitor market demand and consider the condition. That means carrying it to a candlelit dinner might not be your smartest financial move.

But handbags aren’t the only collectibles catching investors’ eyes. Since Janaury 20, the S&P 500 has dropped about 15.6% — and nearly 20% from its February 19 peak — while gold has climbed nearly 30%. That contrast has investors turning to tangible assets as hedges against inflation and volatility.

Luxury goods, fine watches, vintage cars, even wine — they’re all part of a broader shift toward diversifying wealth outside of traditional markets. But the key is to know what holds value and why. Luxury goods aren’t just nice-to-haves anymore; they’re smart, resilient investments.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

This post was originally published on this site be sure to check out more of their content.