Tapestry Inc. shares jumped the most since April 2020 after it raised its guidance again for the year on stronger-than-expected sales at its biggest brand Coach.

Article content

(Bloomberg) — Tapestry Inc. shares jumped the most since April 2020 after it raised its guidance again for the year on stronger-than-expected sales at its biggest brand Coach.

Article content

Article content

The handbag company now sees revenue of more than $6.85 billion in the current fiscal year, the company said Thursday in a statement. That would be a 3% increase from the prior year. The company had already raised its sales guidance in November.

Advertisement 2

Story continues below

Article content

Tapestry said sales increased 11% at Coach on a reported basis in the most recent quarter. That jump in revenue was more than analysts had been expecting.

The stock surged as much as 20% in Thursday trading in New York. Tapestry shares have more than doubled in the last year, outpacing the S&P 500 Index, which is up 23%.

Ralph Lauren Corp. also raised its guidance on Thursday, pushing shares up 16%, the most in a year.

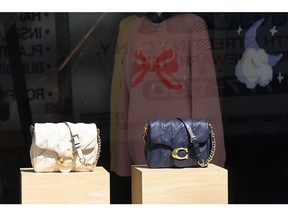

Coach price points

The continued strength at Coach is in part because of the effective price point of its handbags — positioned between mass market and luxury — and its customer database, which continues to grow, particularly among younger shoppers, notes GlobalData analyst Neil Saunders.

“This enables Coach to communicate things like new launches very effectively and create some pent-up demand before products even hit the shelves,” he wrote in a research note to clients Thursday morning. “Of course, this only works because the products are good.” Coach’s Brooklyn bag and its wider New York collection have been popular with shoppers in the US and abroad. The Tabby collection also sold well, Tapestry executives told analysts on Thursday, as did a bag charm in the shape of a cherry.

Article content

Advertisement 3

Story continues below

Article content

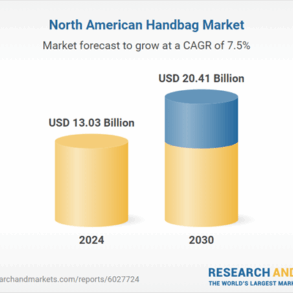

Tapestry’s sales in Europe were $129 million in the most recent quarter, which ended on Dec. 28. That’s up 45% versus a year earlier. Revenue in its largest region, North America, was up 4% to $1.5 billion.

Tapestry also raised its outlook again for profit. The company now expects earnings per diluted share of $4.85 to $4.90. It had previously expected a range between $4.50 to $4.55. The increase is in part because of the $2 billion accelerated share buyback the company announced in November. In addition to that program, Tapestry said Thursday it has $800 million remaining under its previous share repurchase authorization.

The company said its outlook embeds the expectation for an additional 10% tariff on goods imported from China into the US, which isn’t expected to have a material impact on fiscal 2025 results.

Executives said Tapestry has no production in Mexico or Canada and little production in China. The company isn’t trying to predict the future of US trade policy, Chief Financial Officer Scott Roe said in an interview. “What we’re doing is building agility into our supply chain.”

Advertisement 4

Story continues below

Article content

Tapestry’s results are in stark contrast to its rival Capri Holdings Ltd., which said on Wednesday that sales in the most recent quarter fell 12%. Tapestry executives had planned to acquire Capri, which owns Michael Kors and Versace, and reverse its sales slump. But after a federal judge ruled the deal would harm competition, the two companies called off the acquisition in November.

Since then, Tapestry’s shares have risen, underscoring the relief from some on Wall Street that Tapestry won’t get mired in turning around Capri and can instead focus on continuing to boost sales at Coach and lifting revenue at its struggling Kate Spade brand. Sales at Kate Spade fell 10% in the most recent quarter, more than expected.

“We need to sharpen our execution,” Tapestry Chief Executive Officer Joanne Crevoiserat said in the interview. Kate Spade will reduce the number of styles it sells by more than 15% this fall versus the previous year to streamline its offering, while also reducing discounts and investing more in marketing. The brand appointed a new CEO late last year.

Ralph Lauren guidance

Ralph Lauren also raised its full-year guidance and now expects constant currency revenue to increase 6% to 7%.

The company has been focusing on selling more full-priced items, in a bid to move away from discounts that can cheapen shoppers’ perception of the brand, and at the same time increasing the average price of its items.

(Adds executive commentary and updates shares trading.)

Article content

This post was originally published on this site be sure to check out more of their content.

Comments