There’s nothing quite like the anticipation of unboxing a new addition to your luxury handbag collection – gently unwrapping crepe paper is an unparalleled moment of satisfaction.

Beyond mere ownership, the elegance of a Hermès Birkin or the timeless allure of a Chanel Flap transforms these handbags into iconic investments that appreciate in value year after year.

For those interested in exploring the world of trading luxury handbags, Bazaar Arabia offers an in-depth guide covering everything from selecting top brands and models to maximising your investments.

8 Of The Best Handbags To Invest In – And Why

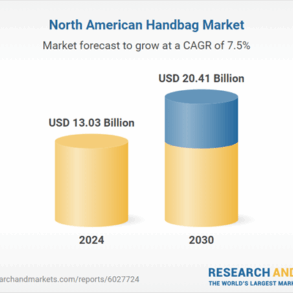

The Luxury Handbag Market

In the dynamic realm of luxury fashion, handbags have transcended their role as mere accessories to become tangible investments. Fashion enthusiasts and investors alike are increasingly drawn to the evolving market complexities, fuelling the burgeoning allure of designer handbags.

Consider, for instance, the Mini Hermès Kelly bag, which today indisputably tops any list of handbags with the best resale value, signalling a shift where these accessories are as valuable on the balance sheet as they are on the arm.

Hermès has gained popularity as not only one of the top luxury brands but also a leather goods maker that provides investment pieces – the plethora of social media pages sharing advice on how to purchase and resale a bag is a testament to this.

Luxury houses such as Chanel and Goyard, known for their focus on craftsmanship, also offer models that seem to only appreciate in value.

What To Consider When Investing In A Luxury Bag

When a handbag collector steps into a boutique, they have a precise vision – from the color to the exact style that complements their wardrobe. However, for those viewing the purchase as a financial decision, a discerning eye is crucial, necessitating consideration of factors beyond mere aesthetics.

Among the myriad of luxury handbag labels, several stand out as industry leaders, each offering a unique blend of style, quality, and craftsmanship. From Hermès’ rich heritage to Chanel’s innovative designs, these iconic brands continue to set the standard for excellence in handbag design.

Just as with investing in a company, assessing the reputation and legacy of a brand is crucial. To maximise the value of your handbags, consider purchasing from flagship stores and be mindful of the country where you plan to resell.

For those investing in pre-owned pieces through trusted online platforms and auction houses, exercising caution and diligence is essential to ensure the authenticity and quality of your purchases

8 Of The Best Handbags To Invest In

Here’s a curated a list of eight of the styles that have proven to be high yield pieces.

Kelly: For many years, the Birkin topped all Hermès bags in demand and resale value. However, today, the Mini Hermès Kelly bag has risen to the top of the list of pieces that have the maximum returns. The sheer work that goes into handcrafting a Kelly, the scarcity of the style combined with its high demand is what gives it the high resale value.

According to the auction house Sotheby’s website, in order to purchase an Hermès Kelly bag, clients must build a strong relationship with a sales associate.

Birkin: While the Kelly is arguably the most desired bag by the brand today. The Birkin still seems to hold its status in the luxury bag realm with its 25 cm version being the most sought-after size.

In recent years, many Hermès Birkin bags have increased in value by 127 to 138 per cent on the resale market. Sotheby’s has a dedicated page listing the accessory with bags starting from Dhs 18,365 ($ 5,000) up to an astonishing Dhs 1,101,900 ($ 300,000) for a crocodile leather version. The rarity of the style, colour and material plays a big role in the resale value of Birkins.

Constance: Known to complete the Hermès “holy trinity”, the Constance has had a steady track record of appreciating in value over the years.

According to the Hermès website, in 1967, the Executive Chairman of the brand, Jean-Louis Dumas, asked a designer to create a bag for the French luxury goods house. The young woman, who was pregnant at the time, named the model after her new daughter, Constance. Ever since, the model has been known to be enjoyed as an heirloom piece, passed from mothers to daughters, which also indicates its durability.

Picotin: While it may not bask in the same limelight as the Birkin or Kelly, the Hermès Picotin Lock exudes its own understated charm, quietly ascending the ranks in terms of resale value. Surprisingly, its petite 16 cm iteration that can fetch an impressive 120 per cent return when it hits the resale market.

Chanel Classic Flap: An embodiment of Chanel’s timeless allure, the Classic Flap bag remains a steadfast symbol of enduring elegance. Interestingly, it’s the smaller Flap version that steals the spotlight as the ultimate investment, outshining even its mini counterpart.

Chanel 22: The Chanel 22 was introduced in 2022, so there is not an extensive track record to evaluate. However, according to various fashion blogs it’s swiftly establishing itself as a darling of the fashion world, destined for appreciation in value

Louis Vuitton Neverfull: Known to hold an average retention value of 100 per cent or more, it’s regarded as the most value-retaining bag out of the French luxury house’s large collection of bags. Perhaps it’s the Neverfull’s practical design and timeless aesthetic that has kept it at the top of the favourites list from the brand.

me.louisvuitton.com

Goyard St. Louis Tote: The brand’s bags hold an elusive charm heightened by limited availability and unwavering demand. This particular tote is highly sought after especially if you don’t live close to one of the limited Goyard boutiques.

Care And Maintenance

Seasoned bag collectors and investors will vouch for how important it is to preserve the condition of your luxury handbags.

By following recommended storage practices and investing in professional cleaning and restoration services, collectors can ensure that their handbags remain in pristine condition for years to come.

The material and its durability when it comes to its lasting power also play a big role. For example, some leathers can be softer and more durable than others but they may also require conditioning.

Investment Strategies

For those looking to start a luxury handbag collection, understanding market trends and timing investments is key to success. By diversifying their portfolios with handbags from different brands and styles, investors can maximise their potential returns and mitigate risk in an ever-changing market.

Now that you’re all equipped to enter the realm of investing in handbags – get shopping!

Lead Image Credit: Photography: Efraim Evidor. Styling: Laura Jane Brown.

Image courtesy of Harper’s Bazaar Arabia’s February 2023 issue.

From clutches to carryalls, these luxury pieces not only enhance your wardrobe but also make for an excellent investment

This French maison knows a thing or two about producing valuable keepsakes, and these exquisite handbags are some of the most sought-after gems in the world

Made from fine calfskin and nappa leather, the Italian fashion house’s crescent-shaped moon bags create an optical sense of equilibrium with their elegant curves and smooth edges

This post was originally published on this site be sure to check out more of their content.